SECURE PAYMENT PROCESSING

Protect Cardholder Data and Optimize Payment System Security

Data-Centric Security and Payment Systems

Streamlining payment processing entails navigating through a complex network of parties and operations to ensure successful transactions. Moreover, financial services companies and organizations must proactively address diverse security challenges and complex regulatory requirements with PCI DSS v4.0 beyond standard processing operations to attain true success.

As a PCI Security Standards Council partner and drawing from over 25 years of experience, comforte specializes in helping organizations that provide or manage payment processing platforms to adopt data-centric security. Comforte solves compliance challenges with PCI DSS v4.0 across various regulatory requirements while simultaneously aligning with business goals and objectives with payment systems.

Key benefits

Utilize comforte’s Data Security Platform to meet the stringent regulatory demands of PCI DSS v4.0, encompassing requirements over protection, access controls, configurations, and audits.

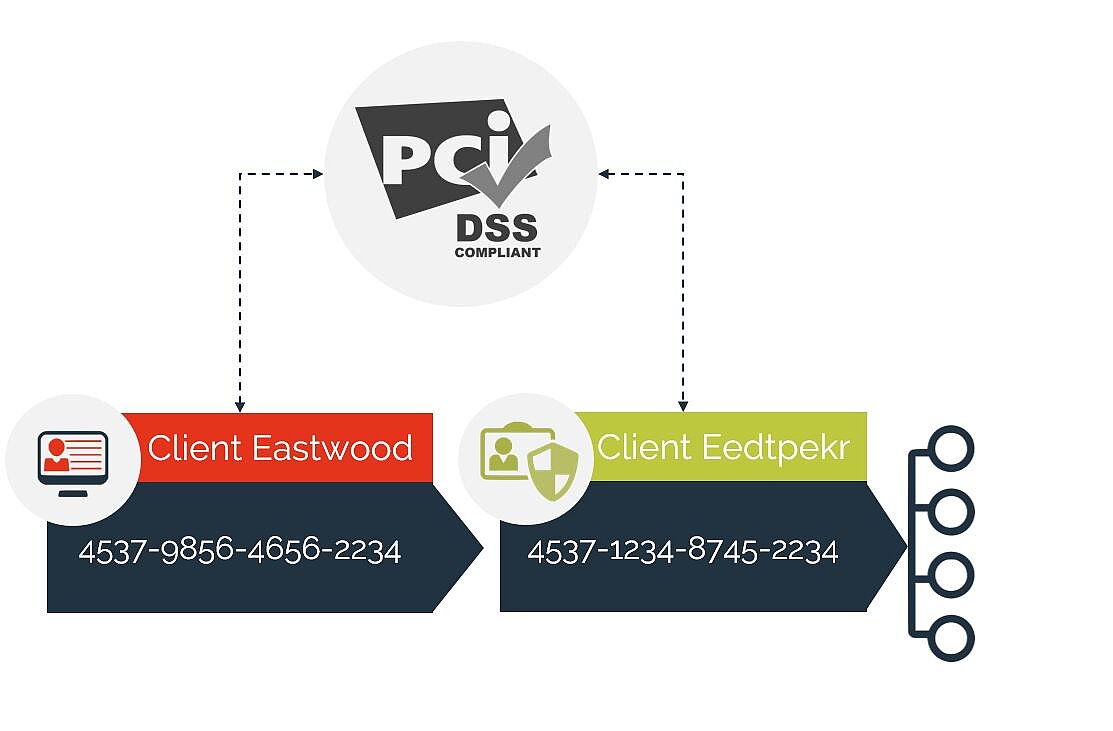

Implement advanced data protection technologies like tokenization and format-preserving encryption to adhere to rigorous cryptography standards.

Seamlessly integrate our platform with IAM tools for precise role-based access controls and secure configurations. Streamline audits and enhance security by leveraging our capabilities, including data discovery and classification for comprehensive visibility into the cardholder data landscape and identifying vulnerabilities.

Enhance the protection of cardholder data itself with comforte's Data Security Platform, reducing reliance on legacy solutions and existing security policies. This optimization strengthens security posture against unauthorized access, data breaches, and other vulnerabilities.

Highlight these capabilities to underscore organizational commitment to cardholder security, fostering customer loyalty and expanding market share while also distinguishing your enterprise brand from competitive products, services, and offerings.

With agnostic approaches, seamlessly integrate into any payment processing platform, eliminating dependence on a single vendor platform with vendor-specific data protection technologies.

Utilize tokenization to circumvent reliance on processor tokens, mitigating key rotation challenges and reducing costs. Capitalize on format-preserving standards, offering utility in data analytics, insights, and operational processes while ensuring PCI compliance.

Harness advanced data protection technologies such as tokenization and format-preserving encryption to safeguard cardholder and other sensitive data.

These data-centric strategies render information unusable to malicious actors, significantly mitigating risks. By effectively thwarting fraudulent activities, this approach preserves customer trust and the integrity of payment systems.

Employ data discovery and classification to derive data-driven insights about your target customer base. By identifying and analyzing unknown data elements across the entire payment system environment, refine analytical findings to enhance marketing strategies and product features that align more closely with customer needs and desires, all while maintaining regulatory compliance and security standards.

Proof and Success

Payments Security for ACI Retail Payments Solution (RPS)

- Elevate security for BASE24 and BASE24-eps

- Ensure adequate protection of cardholder data throughout the entire payment environment

- Simplify compliance with PCI DSS v4.0